Regardless of the asset type that you are trading, the principle of how profit and loss is calculated on a cfd trade is the same. Whether your cfd is in gold, gbpusd or the nasdaq 100 index, you wont own the underlying asset, but are instead speculating on how the assets price will move. Trading using leverage can incur overnight. Cfd trading and forex trading both involve speculation on price movements and the use of leverage. The key difference lies in the range of assets available for trading:

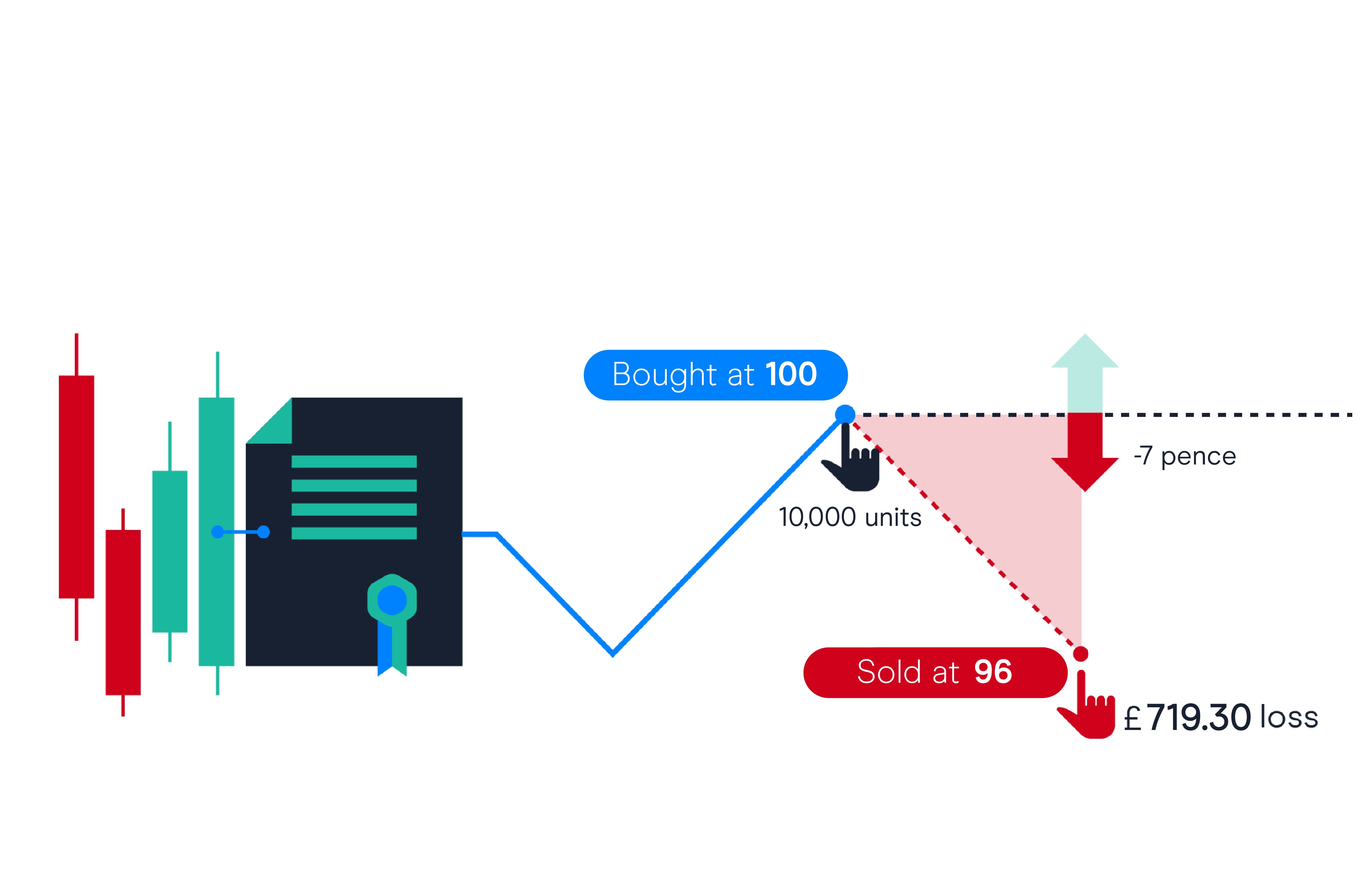

Cfd trading, or contract for difference trading, is a financial arrangement where you dont actually buy or sell the underlying asset (like stocks, commodities, or currencies),. Cfd trading involves high risk and leveraged positions in financial markets, requiring skill, analysis, and an understanding of market movements. While it shares risk and speculation attributes with gambling, cfd trading is based on financial strategies and market analysis, distinguishing it from pure gambling, which relies on chance. A cfdis an agreement between you and a broker to exchange the difference in an assets value between: The price when the contract opens, and 2. The price when the contract closes the difference between the two values will be either your profit oryour loss, depending on how you choose to enter the contract. Cfd trading is the method of speculating on the underlying price of an asset like shares, indices, commodities, cryptos, forex and more on a trading platform like ours. A cfd short for contract for difference is the type of derivative that enables you to trade the price movements of these financial markets with us. Learn what contracts for difference (cfds) are, how to trade them, and more. How to place a cfd trade; Decide to buy contracts (go long) or sell (go short) select how many cfds to.

Decide to buy contracts (go long) or sell (go short) select how many cfds to.

Keberangkatan Haji 2025 Tgl Berapa